CRE Zone 1

An average market update from a simpleton finance broker who only sees what he sees and nothing beyond those seas

I figured, as the directive of this blog, originally, was to be extremely commercial real estate focused - I should do a post that is a bit more hyper focused. Yet, I am still simple in my perspectives and this will include no statistical analytics as that plays very little into my position, in the sense of securing clientele or servicing them.

I do not have a major interest in disclosing in depth as my role in being publicly anonymous does not provide me the same transparency as someone who is publicly doxxed. I have other advantages that they do not have, which is that I can spill chili…

Simply put - I will not share more than what needs to be shared.

Across our desk lately, we’re seeing an aggressive amount of pending developments. It is safe to say that nearly all, if not all, have had some underlying BTR component

BTR = Build To Rent

With that said, it’s a clear indication that the residential sector is set to receive the long discussed/rumored correction, that has been, in essence, marinating for ~5 yrs

This is great news for individuals who have been sitting on their hands, waiting for a divine buying opportunity to arise. We should see those sales begin to take place this year and next, showing retractions that should settle many markets where pricing has been heavily inflated, creating a lack of individuals aged 18-30 submitting offers.

With such a heavy focus on BTR, and development overall, for those in the market to purchase a home, finding a way to have an investment exit is always a major key to building net-worth. Many use the 24 month rule and build that way, using FHA multiple times, if you’re privy to knowing how to work the game in proper posture.

While BTR is live, folks are still trying to BRRR their ways to greener pastures, this is going to be a tough position for many who have bridge loans expiring over the next two years. As the market corrects, ARVs will drop, which will place investors in positions where they may have to ‘cash-in' refinance. Otherwise, they will be at risk to lose the asset and go into foreclosure, which again, opens up a whole can of worms.

Many buyers, both on the personal and investment fronts, will find opportunities in the market where someone either completed the rehab or nearly completed. This is where your ability to be an intellectual buyer comes in handy.. Know which lenders do what and find a way to get on their buyers list. Yes… There will be REOs out the A$$…

Moving on from residential, we are clearly seeing office suffer from dramatic shifts in the work flow of various organizations. This has resulted in many opportunities, primarily on the buy side, yet many are still watching the bleeding from arena seats, which is where I would stay, as I only see the suffering at its very beginning stages, as most do. Those who approach this asset type, must also carry the right personality type. The office environment has been ever evolving, why? because corporate America eats A$$ and people don’t like having their bubbles deflated by shitty co workers or less than respectful management/executive staff. I only see the ability to work this asset type creatively or find ways to secure long term leases and get tf out of there...

Office is Off Ice - it’s the Meth Capital of the world to be solely in this class, i’d be turding bricks and declining calls from chicks, while searching for mescaline

Now that we’re off ice, lets discuss retail. A sector that I feel is a bluffing market, and I’ve felt that way since underwriting deals of this type. You either know what you’re doing, or you don’t. That’s how simply CRE can be. If you don’t know, find help.

Retail is one of those asset classes that is only going to find more and more tenants, especially in a very capitalistic environment, which clearly, most sub 30 individuals are pretty heavy in wanting to play this game. That said, the small businesses of today could and will be the national tenants of tomorrow. Retail operators have the first look and opportunity to build bridges for new entrepreneurs, a catalyst for the American Dream - that is what we call ‘Retail’ and also, INDUSTRIAL

This asset class appears impenetrable, for various delegated reasons, the main being, AMERICA DOES NOT STOP - WE KEEP GOING, NO MATTER THE STORM

Industrial is a class that truly embodies ENTERPRISE, and that whole sector is seemingly becoming more and more OPTIMIZED. As various E-Commerce investors build their digital stores, and more brands expand aggressively, in every field, we will see a major need for space. ‘Kids’ just need to learn to take more risks than they are. Once brokers / agents start to become more creative in their prospecting tactics for new buyers, we will start to see an education about leasing industrial property that should further increase occupancy, the heaviest piece will be convincing them of the added value to their business ops, without focusing on the value they will experience, many younger successful internet rock stars will keep ops in place as is, find a way to have them focus stateside.

Mixed Use is Mixed Use - this is a good market to be in if you’re a developer of MU. A lot of these asset types have drastically suffered since covid, yet the zoning is already in place to take things to the next level if your capital alignments are strong enough. I foresee a lot of East Coast assets being torn down in this sector to allow for new, fresh bones that will attract some of these ‘higher standard’ tenants, who are also the more credible and desired tenants. I personally love the Mixed-Use asset type more than any other - this encompasses so many unique properties and solution based designs, from flex buildings to self storage to multi-story condos, this sector is truly unique.

Multifamily has no divine unique love from my heart, I look at apartment complexes the same way I look at the Humane Society, kennels on kennels. This is why I feel the dramatic increase in the BTR sector is going to create so many residential buying opportunities for those looking to move out of the dog pounds. To each it’s own, however, I will say there are many convenience factors that are great but…

Yes, I mean that caption, not going to go into detail on that. besides saying that, more convenience = more pleasure = more consumption = inflammation = Dis-Ease = Death

Okay now moving onto the last damn thing imma cover since I been typing for a bit…

Nothing is Easy Right Now - and nothing should be… Sure, it looks cool to do real estate and doing it right yields highly, but don’t accept easy - that’s a death wish here.

See beyond the veils of thin lines - adding value is synonymous to going bankrupt

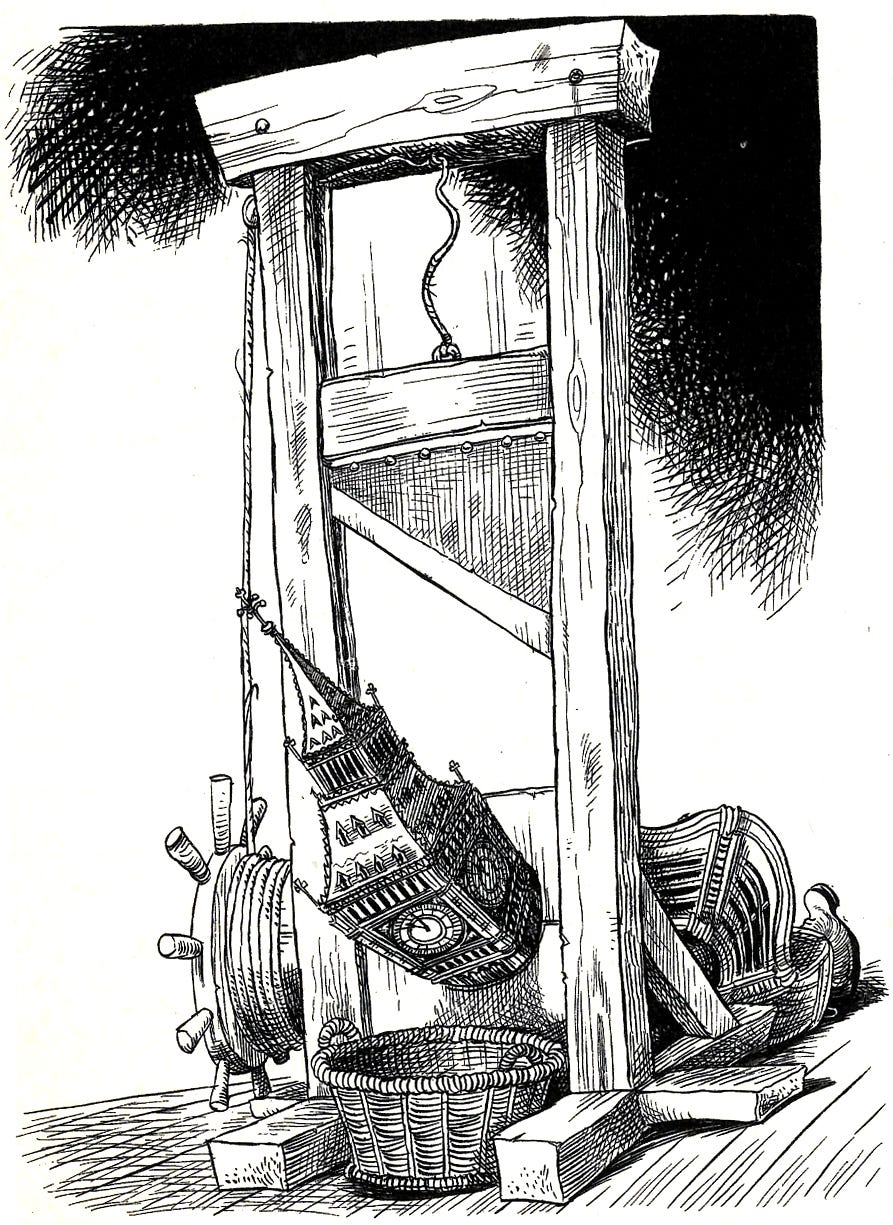

Why say going bankrupt? The market breed a lot of grifting noobs, who knew how to swindle at the right times and secure capital available in the markets. What about when HELL WEEK comes? that’s what you should be weary of - whether your GP Growing Passive or General Pussy - weed out the wicked. That is your sole purpose as an accredited investor participating in PE - knowingness is certainty, execution is action or a guillotine - listen to your certainty and choose your form of execution…